tax benefit rules for trusts

EFRBSs are retirement benefit schemes that operate outside of HMRCs registered pension scheme rules under Finance Act 2004. Chat With A Trust Will Specialist.

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

It shouldnt but it is not programmed like the 1040.

. However the tax rules can help with this. Enter the refund as income then back it out As. Capital gains tax benefits of trusts.

Find out more by reading the information on. One of the tax advantages of a family trust is related to Capital Gains Tax CGT. Tax Exempt Bonds.

Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan. If the settlor has more than one trust this. Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan.

Trust fund taxes are income taxes social security taxes and Medicare taxes you withhold from the wages of an employee as their employer. All of the tax rules for hiring employees apply to resident managers but there are a couple of special rules you need to know about. Charitable Trusts and NGOs Tax Benefits List.

Trusts also benefit from a 50 Capital Gains Tax CGT discount when compared to registered companies. The first 1000 is taxed at the standard rate. Contributions to a 2503 trust can constitute a.

The grantor trust rules in IRC 671-678 are anti-abuse rules. Sometimes the settlor can also benefit from the assets in a trust - this is called a settlor-interested trust and has special tax rules. Charitable deduction rules for trust and estate income taxes and transfer taxes are found in different Code sections from the rules for individual income taxes.

Tax benefit rules for trusts Sunday March 6 2022 Edit. Built By Attorneys Customized By You. They prevent the grantor from taking tax advantages from assets that have not left his or her control.

111 partially codifies the tax benefit rule which generally requires a taxpayer to include. Chat With A Trust Will. Section 2503 presents a narrow exception to that requirement of a present interest rule which has significant tax benefits.

The tax benefits of trusts vary from one country to another but often include some sort of tax exemptions that make it possible for the beneficiary to avoid paying inheritance. Many estate plans that utilize Jointy. One potential issue with creating a trust is having the cash resources to make a gift.

They can be funded or unfunded and usually. This is available for the disposal of assets held for over 1 year. Trustees are responsible for paying tax on income received by accumulation or discretionary trusts.

The following Sections of the Income Tax Act allow tax exemptions for charitable trusts and NGOs in India. Rather than selling an asset. Excepted Group Life Trusts to remain subject to inheritance tax rules.

In some cases a grantor trust will have to file a return on Form 1041 but the only entry will be a statement saying that all income was carried out to the grantors tax return. Since trusts enter the highest tax bracket 37 once they exceed 13051 of taxable.

What Is An Irrevocable Trust How Does It Work Free Video Explains

Living Trusts For Everyone Why A Will Is Not The Way To Avoid Probate Protect Heirs And Settle Estates Secon Living Trust Setting Up A Trust Things To Sell

All You Need To Know About Institutional Donors In Your Fundraising Strategy For Your Non Profit Proposa Fundraising Strategies Grant Writing Proposal Writing

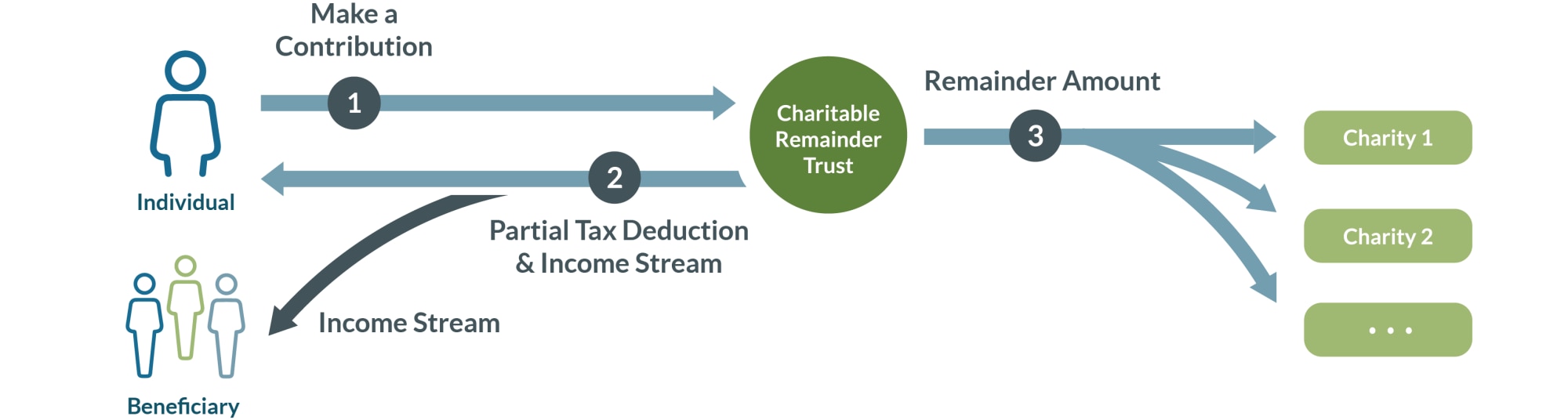

Charitable Remainder Trusts Crts Wealthspire

Cbdt Condones Of Delay In The Filing Of Form 10bb By Trusts And Institutions Institution Taxact Tax Rules

To A B Or Not To A B That Is The Question Botti Morison

Charitable Remainder Trusts Fidelity Charitable

Why Domestic Asset Protection Trusts Don T Work Http Www Assetprotectionpackage Com Why Domestic Asset Protection Trusts Dont W Investing Protection Secrecy

Why Everyone Needs An Estate Strategy William H Bryan Retirement Advice Investment Advice Investment Advisor

Where To Store Important Documents Adoption Papers Certificate Of Deposit Important Documents

Generation Skipping Trust Gst What It Is And How It Works

Exploring The Estate Tax Part 2 Journal Of Accountancy

Tax Advantages For Donor Advised Funds Nptrust

Will Section 529a Plans Replace Special Needs Trusts Financial Advisory Financial Advisors Social Security Benefits

What Is A Charitable Remainder Trust Carolina Family Estate Planning

Pin En End Of Life Management Tools

Distributable Net Income Tax Rules For Bypass Trusts

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide